KNOWLEDGE IS POWER!

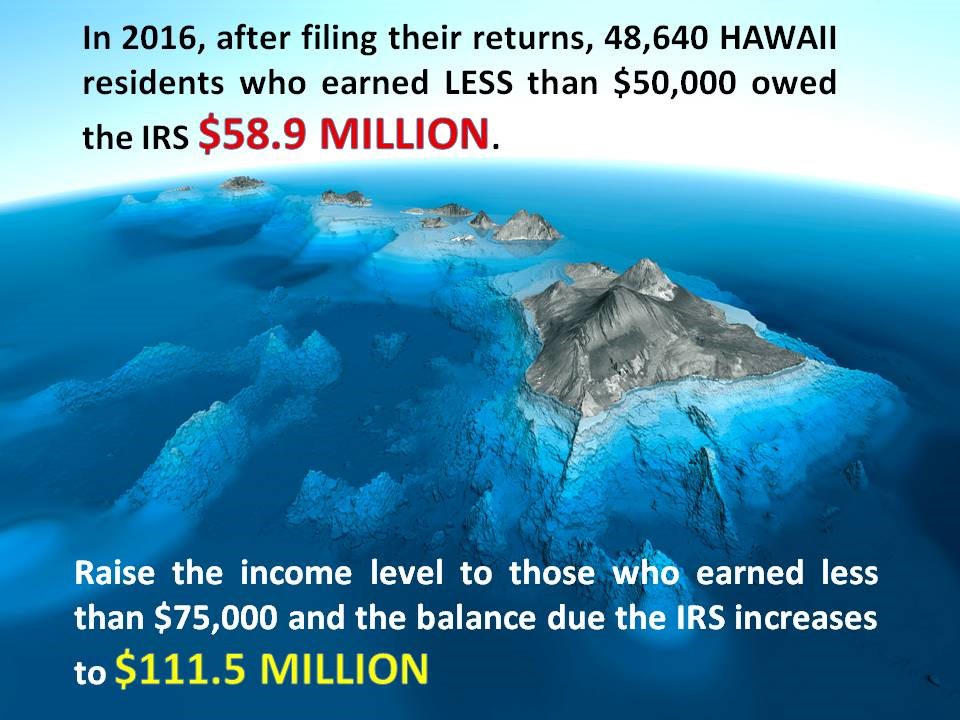

Most of the Hawaii residents who ended up owing the IRS additional taxes after filing their tax returns could have avoided that problem if they had some basic tax knowledge.

DID YOU KNOW?

- The amount of debt forgiven by a creditor (e.g. a credit card company) is considered taxable income for the debtor (person who owes the debt)?

- Scholarship and grant funds which are used to pay for room and board can be considered taxable income?

- Unemployment benefits are taxable?

- Withdrawal of pension/retirement funds before the age of 59 1/2 will result in a tax penalty of 10%?

- Making contributions into an IRA after age 70 1/2 will result in a tax penalty?

- Trading a service/product for a service/product (bartering) is a taxable transaction?

- Income from a hobby is taxable?

- Alimony is taxable income for the person receiving it?

- Bitcoin (virtual or digital currency) is taxable?

- Jury pay is taxable?

- You MUST file a tax return if you are self-employed and your NET self-employment income is $400 or more

AVOID TAX DEBT

If you didn’t know these important facts, consider signing-up for Hawaii VITA’s tax tips which will cover tax debt prevention, provide education on tax credits and much more. You can also follow us on Twitter and Facebook